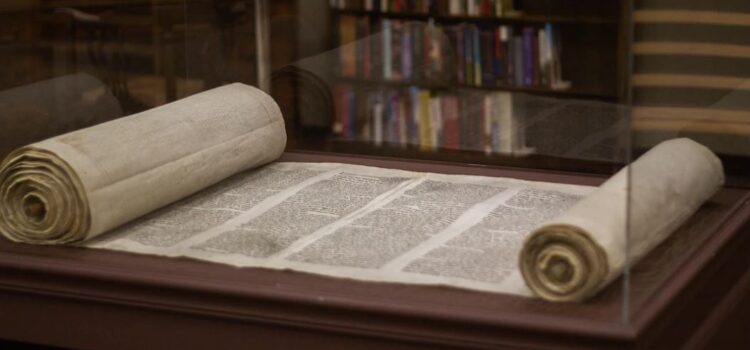

Are you looking for The Greatest Salesman in the World quotes by Og Mandino? What are some of the most noteworthy passages worth revisiting? Written in 1968, The Greatest Salesman in the World by Og Mandino teaches that to achieve any goal, you need to develop the habits and attitudes of a great salesperson, which means acquiring self-confidence, emotional control, persistence, generosity, humor, and humility. The book’s ten principles (contained in the scrolls) provide a framework centered around positive thinking and self-discipline, the building blocks of any kind of self-improvement. Below is a selection of The Greatest Salesman In the World

The Greatest Salesman in the World: Quotes