This article is an excerpt from the Shortform book guide to "The Success Principles" by Jack Canfield. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here .

Do you save money? At what age do you think you should start saving for retirement? What’s the importance of saving money?

Many people balk at the idea of consistently saving money. They may be deeply in debt or may not think saving is important. Though saving money may not seem important, it’s necessary to ensure you have enough money to retire comfortably.

This article discusses the importance of saving money and how to do it to be able to recover comfortably.

The Power of Compound Interest

Saving money for retirement will help you reach financial independence—not having to work for money. But many people don’t know how to effectively save. We’ll discuss the importance of saving money for your golden years.

Even saving a small amount of money each month can go a long way over the long term. Saving early and regularly not only helps you put money away, it allows your money to earn interest that compounds over time.

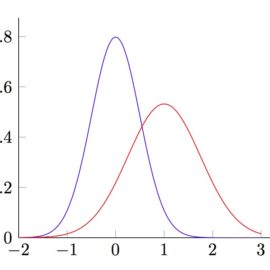

Here’s how compound interest works: If you invest $1,000 into a fund or account that earns 10 percent in annual interest, you’ll earn $100 by the end of the year for a total of $1,100. If you reinvest the $1,100, you’ll accrue $110 in interest for a total of $1,210. If you keep reinvesting your initial investment and the interest you earn each year, the amount of money you have will double every seven years. The earlier you start investing, the more time the money has to grow and earn interest.

Example: Mary and Tom each invest $150 per month into accounts that earn 8 percent interest. But Mary starts when she’s 25 years old and stops investing when she’s 35. In contrast, Tom starts when he’s 35 and continues to retirement age. When they each turn 65, they’ll have different amounts of money, as shown in the following table:

| Age (Starting investing) | Age (Stopping investing) | Amount Invested Per Month | Annual Interest | Amount Invested Over Investing Period | Money at Age 65 | |

| Mary | 25 | 35 | $150 | 8% | $18,000 | $283,385 |

| Tom | 35 | 65 | $150 | 8% | $54,000 | $220,233 |

Even though Mary only invested money for eight years, she reaches age 65 with an additional $63,152 due to interest compounding over 40 years versus Tom’s 30 years.

Tips to Save

Here are five tips to save enough money:

1. Save at least 10 percent of your income per month. It may not seem like much, but even just saving a small amount now helps you save later.

2. Save more than you spend. This tip is also called the 50/50 law because to save more than you spend, you effectively can’t spend more than 50 percent of what you earn. This rule was developed by Sir John Marks Templeton, a stockbroker. He and his wife decided to invest 50 percent of what they earned in stocks and give 10 percent of their income as tithes to their church, leaving them to live on just 40 percent of their income. He became a billionaire.

3. Invest automatically each month. The best way to ensure that you save money each month is to set up automatic contributions to retirement funds. Depending on your employment situation, there are two ways to do this:

- Use your company’s retirement plan. If your company offers a 401k or other retirement plan, choose to have a portion of your income directed there each month. That way, it’ll be automatically set aside before you get your paycheck and you won’t have to pay taxes on the money until you use it. If your company matches what you put into your 401k, take advantage: Make the largest contribution you can legally. Ideally, contribute at least 10 percent; however, if that feels like too much, contribute as much as you can.

- Open your own IRA or Roth IRA. An IRA, or Individual Retirement Account, is a great way to save money if your employer doesn’t provide a 401k. Ask a financial advisor whether an IRA or Roth IRA would be best for you. You can contribute $5,500 per year to a traditional IRA, or $6,500 if you’re 50 or older. Set up an automatic transfer from your bank account into this account so that you don’t have to think about it.

4. Consult with a financial advisor. A financial advisor can tell you how to best invest your money, or can do it for you. Ask friends if they have a financial advisor they recommend, or look for someone who has experience managing the finances of someone in the same stage of life as you. Make sure they charge a flat fee rather than a variable rate based on how much money you have.

5. Insure your assets. Protect your assets with insurance or legal agreements. This could include a prenuptial agreement between you and the person you’re planning to marry or liability insurance if you’re self-employed.

Don’t Just Save; Invest: Oseola McCarty’s Story

Oseola McCarty, a resident of Hattiesburg, Mississippi, had to drop out of school in the sixth grade to care for her family. She spent the next 75 years doing housework such as ironing and washing clothes while saving as much of her earnings as possible. By 1995, she had amassed $250,000 in savings and chose to donate $150,000 to the University of Southern Mississippi to be used for scholarships for students in need. As generous as this was, McCarty could’ve grown her wealth even more if she’d invested it in the stock market. In 1965, she had an estimated $50,000 in savings. If she’d invested it at that time in a fund earning an average of 10.5 percent interest, she would’ve had approximately $999,628 by 1995.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Jack Canfield's "The Success Principles" at Shortform .

Here's what you'll find in our full The Success Principles summary :

- The 67 principles to help anyone achieve their goals and dreams

- Why achieving your goals requires you to invest your time and effort

- How to take responsibility for your own life