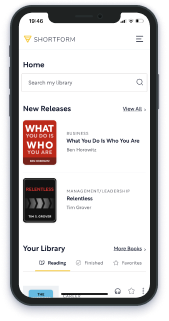

This article gives you a glimpse of what you can learn with Shortform. Shortform has the world’s best guides to 1000+ nonfiction books, plus other resources to help you accelerate your learning.

Want to learn faster and get smarter? Sign up for a free trial here .

Do you regularly put money aside in a savings account? Why is it important to save money?

We’re taught from a young age that saving money is important, but many people don’t have savings because they can’t resist the temptation to spend. This can be dangerous because emergencies can strike anytime. Furthermore, saving money is instrumental in building wealth.

Keep reading to learn about the benefits of saving money and what you should do with your savings.

The 3 Benefits of Saving

According to Morgan House, the author of The Psychology of Money, there are three main benefits of saving money:

1) Saving is essential to building wealth due to the nature of wealth: Since wealth is the money you don’t use, it’s the money you save—meaning you can’t build wealth without saving money.

2) Saving is the most reliable way to build wealth because it’s totally in your control. Other wealth-building methods, like investing or increasing your income, are full of uncertainty. But saving isn’t: You always control how much you save, and saving will be just as effective tomorrow as it is today.

3) Saving is a comparatively easy way to build wealth: It’s much easier to save money you already have than it is to increase your income or your investment returns.

TITLE: The Psychology of Money

AUTHOR: Morgan Housel

TIME: 52

READS: 120.4

IMG_URL: https://www.shortform.com/blog/wp-content/uploads/2022/02/the-psychology-of-money-cover.png

BOOK_SUMMARYURL: the-psychology-of-money-summary-morgan-housel

AMZN_ID: XYZ

Build a Safety Net

That being said, you have to save consistently and over a long period of time to be able to accumulate a substantial sum of money to invest and multiply it. This is one of the main reasons people find it hard to save money consistently: It’s hard to say no to the rewards of spending money now in favor of the rewards that will come in the future.

However, there are also short-term benefits of saving money: It’s essential to save money so you can have a safety net to fall back on in case of emergencies. According to David Bach, the average American has less than three months’ worth of expenses saved—these people are financially unprepared for the bad, unexpected things that could happen such as isolating at home and quitting work due to a pandemic.

In his book The Automatic Millionaire, Bach stresses the benefits of saving money for a rainy day and gives a couple of tips for building your financial safety net:

- Save at least 3 to 24 months’ worth of savings. To figure how many months you could survive on your current savings, divide the amount of money you have saved by the sum of your monthly expenses.

- Keep your emergency savings separate from your checking account. That way, you will not be tempted to spend the money. Further, he advises that you invest the money in high-yield savings accounts so that it can earn interest and grow.

TITLE: The Automatic Millionaire

AUTHOR: David Bach

TIME: 45

READS: 94.8

IMG_URL: https://www.shortform.com/blog/wp-content/uploads/2021/10/the-automatic-millionaire-cover.png

BOOK_SUMMARYURL: the-automatic-millionaire-summary-david-bach

AMZN_ID: XYZ

Tips to Save Money

Now that you understand the benefits of saving money, how do you actually do it? In his book The Success Principles, Jack Canfield gives a few tips on how to grow your savings slowly but surely over time:

1. Save at least 10 percent of your income per month. It may not seem like much, but even just saving a small amount now helps you save later.

2. Save more than you spend. This tip is also called the 50/50 law because to save more than you spend, you effectively can’t spend more than 50 percent of what you earn. This rule was developed by Sir John Marks Templeton, a stockbroker. He and his wife decided to invest 50 percent of what they earned in stocks and give 10 percent of their income as tithes to their church, leaving them to live on just 40 percent of their income. He became a billionaire.

3. Invest automatically each month. The best way to ensure that you save money each month is to set up automatic contributions to retirement funds. Depending on your employment situation, there are two ways to do this:

- Use your company’s retirement plan. If your company offers a 401k or other retirement plan, choose to have a portion of your income directed there each month. That way, it’ll be automatically set aside before you get your paycheck and you won’t have to pay taxes on the money until you use it. If your company matches what you put into your 401k, take advantage: Make the largest contribution you can legally. Ideally, contribute at least 10 percent; however, if that feels like too much, contribute as much as you can.

- Open your own IRA or Roth IRA. An IRA, or Individual Retirement Account, is a great way to save money if your employer doesn’t provide a 401k. Ask a financial advisor whether an IRA or Roth IRA would be best for you. You can contribute $5,500 per year to a traditional IRA, or $6,500 if you’re 50 or older. Set up an automatic transfer from your bank account into this account so that you don’t have to think about it.

TITLE: The Success Principles

AUTHOR: Jack Canfield

TIME: 90

READS: 118.1

IMG_URL: https://www.shortform.com/blog/wp-content/uploads/2020/11/the-success-principles-cover.png

BOOK_SUMMARYURL: the-success-principles-summary-jack-canfield

AMZN_ID: XYZ

Letting Your Savings Work for You

Once you accumulate a significant amount of savings, it will be tempting to go and blow it all off on expensive products and fun experiences. Don’t do that. Instead, Joseph R. Dominguez and Vicki Robin (Your Money or Your Life) recommend using your savings to ensure your financial security by building a “cushion” and investing your capital in a business that can generate passive income or assets that generate compound interest.

Cushion

Cushion is the readily available cash that lets you weather financial hardship. You’ll keep this money in a savings account, aiming to build it to cover six months of expenses. If you find yourself out of work, you’ll have this cushion to fall back on.

Capital

Savings you don’t need to spend in the short term is your capital: money you can invest to generate passive income. Unlike your cushion, you won’t keep your capital in a bank account. You’ll invest it so that it grows over time.

Compound Interest

Getting your capital to make money for you is one of the keys to reaching financial independence. Investing in bonds or other investment instruments allows capital to accrue compound interest—money that the investment instrument adds to your invested capital.

You can use the following formula to calculate how much interest your savings will accrue each month: monthly investment income = capital x current interest rate divided by 12.

Example: Your first month, you have $100 in capital. The current interest rate is 4 percent. The formula would look like this: monthly investment income = $100 x 4% divided by twelve = $0.33 per month.

In one year, you’d earn $4 in interest ($0.33 x 12) for a total of $104 (your initial investment plus your interest). If you reinvested that a second year, you’d earn $4.16 for a total of $108.16. And so on.

Compound interest exponentially builds savings because it works on both the initial investment and the interest accrued.

TITLE: Your Money or Your Life

AUTHOR: Vicki Robin and Joe Dominguez

TIME: 37

READS: 112.7

IMG_URL: https://www.shortform.com/blog/wp-content/uploads/2020/11/your-money-or-your-life-cover.png

BOOK_SUMMARYURL: your-money-or-your-life-summary-vicki-robin-and-joe-dominguez

AMZN_ID: XYZ

Final Words

Many people balk at the idea of consistently saving money. Living in a culture of instant gratification, they think that the benefits of spending money now outweigh the benefits of saving money for the future. Though saving money may not seem important to you right now, you’ll realize its value when an emergency strikes.

If you enjoyed our article about the benefits of saving money, check out the following suggestions for further reading:

In The Barefoot Investor, Scott Pape offers guidance and a 10-step plan for how to manage your money so that you eliminate debt and build wealth. Though the plan is written for an Australian audience, the basic principles are universally applicable. Starting with establishing regular date nights with your significant other to discuss finances, then covering reducing debt and buying a home, the steps in this book will help you make informed money decisions.

In I Will Teach You to Be Rich, Sethi helps you cut through the noise of conflicting and overly technical financial advice, get past your own hang-ups around money, and take small steps toward a “rich life”—whatever that looks like for you. You’ll learn how to use credit cards wisely, choose the right bank accounts and investment accounts, plan out your spending, and ultimately create a financial system that grows your money automatically.

Want to fast-track your learning? With Shortform, you’ll gain insights you won't find anywhere else .

Here's what you’ll get when you sign up for Shortform :

- Complicated ideas explained in simple and concise ways

- Smart analysis that connects what you’re reading to other key concepts

- Writing with zero fluff because we know how important your time is