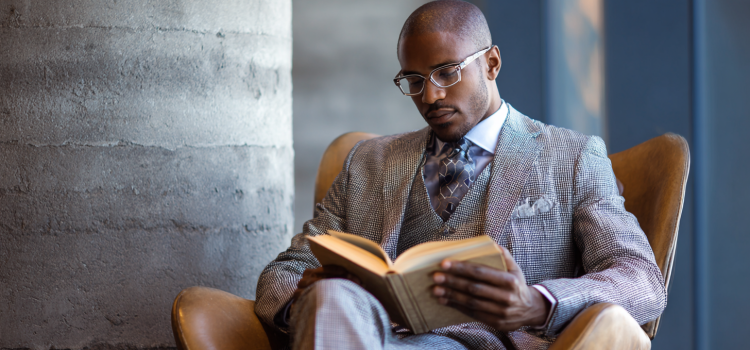

What if creating lasting change didn’t require endless energy, big budgets, or radical overhauls? In Reset, Dan Heath shows that progress often comes from small but strategic shifts. Whether you’re trying to improve your personal habits or lead your organization through a tough transition, Reset argues that you don’t need to do everything—you just need to do the right things in the right places. Drawing on research and case studies, Reset distills practical strategies for making meaningful improvements without burning out. Continue reading for an overview of the book.

Reset by Dan Heath: Book Overview & Takeaways