This article is an excerpt from the Shortform summary of "Blue Ocean Strategy" by W. Chan Kim and Renee Mauborgne. Shortform has the world's best summaries of books you should be reading.

Like this article? Sign up for a free trial here .

Once you’ve figured out an offering that offers superior utility to the customer, you need to figure out how to price it. How much should you charge for your blue ocean strategy product?

Blue Ocean Strategy recommends using the price corridor, a way to maximize the success of your strategy. What is a price corridor, and how does it depend on your business? Learn more here.

How to Price Correctly in Blue Ocean Strategy

A typical approach to pricing is to start with a premium price to attract early adopters, then gradually drop prices to attract mainstream customers. Blue Ocean Strategy argues that you must set a price that will capture the mass of target buyers from the very beginning, for these reasons:

- In many industries, fixed costs have increased and marginal costs decreased. This is particularly true in software and R&D-heavy industries. Therefore, pricing to capture more users will help maximize profits.

- Many products benefit from network effects, where the value of the service scales with the number of users. Marketplaces like eBay and Uber are examples. Lowering the price for mass adoption accelerates the flywheel.

- Fast followers may imitate your strategy quickly once you prove early success. With more funding and more aggressive expansion, competitors may take the lead. Strategic prices help earn reputation and brand immediately to build a defensible position.

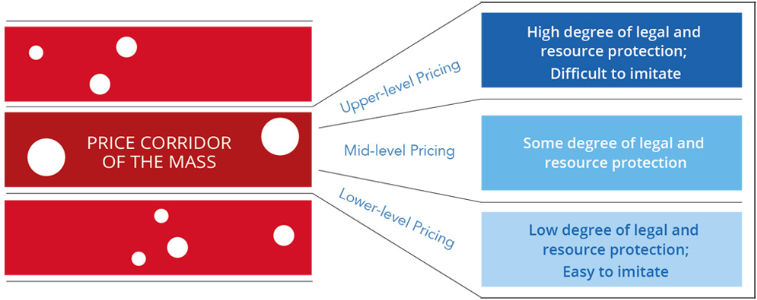

How do you actually set your price? Research pricing for major alternatives to your product, create a price range (or corridor) that will attract the most customers, then set a price within the corridor depending on your defensibility. Here’s an image of what the price corridor looks like.

Basically, if your product is defensible and difficult to replicate, then you can command higher-level pricing. If your product is not defensible, you’ll have to settle for lower pricing.

Establishing the Price Corridor

Start figuring out your price corridor by gathering alternatives to your product.

- Some alternatives will look different but achieve the same function. Horse carriages and Model T both carry people places; parents making lunch serve the same function as school cafeterias.

- Other alternatives will have different forms and function, but the same objective. Movies and restaurants have different functions, but their objectives are to have an entertaining night out. Southwest Airlines considered cheap car travel their alternative. Consider what customers would do if your product didn’t exist.

For each set of alternatives, plot the pricing and the volume of customers you’d attract at that pricing level. For instance, pricing at a luxury level may increase value per customer, but this may not compensate for a drop in volume.

The range of prices that will earn the most total revenue is your price corridor.

Specify a Price Level within the Price Corridor

Now that you have a price range, where specifically you situate in this price corridor depends on your defensibility through IP or competencies. You should price on the lower range of your price corridor if these factors apply:

- Your product has little legal protection through patents or copyright

- Your product has no exclusive assets or capabilities that are hard to replicate

- Your product depends on network effects for its strengths (you need to attract users quickly)

- Your product has high fixed costs and low marginal costs (you need to make up the high fixed costs with volume)

- Your cost structure benefits from economy of scale (volume gives you cost advantages)

If your product is not defensible and you price too high in your price corridor, your blue ocean may initially capture good profits, but fast followers will be attracted by the ocean and compete away the profits.

The authors of Blue Ocean Strategy believe it’s better to capture the bulk of the market first, by pricing in the mass section of your price corridor, and establish brand to ward off imitators.

Examples of Pricing Corridors

- Southwest Airlines had a new idea (direct flights between secondary airports) but low IP defensibility and no exclusive assets. It priced on the budget end, using car travel as its main alternative.

- NTT DoCoMo priced its monthly subscription fee at the price of a magazine, in the range of impulse buying.

- (Shortform example: Uber began with the premium Uber Black as an alternative to taxicabs, but quickly moved into the low-priced mass-market UberX as soon as it became clearly legal. This benefited its network effects on both supply-side (drivers) and demand-side (riders).)

———End of Preview———

Like what you just read? Read the rest of the world's best summary of "Blue Ocean Strategy" at Shortform . Learn the book's critical concepts in 20 minutes or less .

Here's what you'll find in our full Blue Ocean Strategy summary :

- What blue oceans are, and how you create one for your business

- Why some businesses succeed in creating blue oceans, and why others fail

- The red ocean traps you have to avoid if you want business growth