This article is an excerpt from the Shortform summary of "The Black Swan" by Nassim Taleb. Shortform has the world's best summaries of books you should be reading.

Like this article? Sign up for a free trial here .

What is cumulative advantage? How does it work? Why is it dangerous to society? Who does it help?

Cumulative advantage is the idea that small gains compound over time. In the work of Nassim Nicholas Taleb, cumulative advantage refers to the innate human tendency to flock to past successes, regardless of whether those successes are the product of merit or chance.

We’ll cover cumulative advantage, where it’s most prominent, and why the rich get richer.

Extremistan vs. Mediocristan

Before we can understand Taleb’s notion of cumulative advantage, we need to understand his terms “Extremistan” and “Mediocristan.”

To explain how and why Black Swans occur, Taleb coins two categories to describe the measurable facets of existence: Extremistan and Mediocristan.

In Mediocristan, randomness is highly constrained, and deviations from the average are minor. Physical characteristics such as height and weight are from Mediocristan: They have upper and lower bounds, their distribution is a bell curve, and even the tallest or lightest human being isn’t much taller or lighter than the average. In Mediocristan, prediction is possible. Cumulative advantage isn’t a huge issue here, as we’ll see.

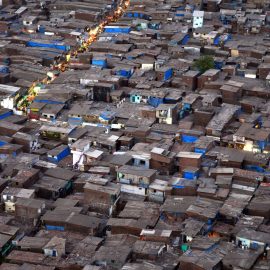

In Extremistan, however, randomness is wild, and deviations from the average can be, well, extreme. Most social, man-made aspects of human society—the economy, the stock market, politics—hail from Extremistan: They have no known upper or lower bounds, their behavior can’t be graphed on a bell curve, and individual events or phenomena—i.e., Black Swans—can have exponential impacts on averages. This is the world where cumulative advantage runs rampant.

Imagine you put ten people in a room. Even if one of those people is Shaquille O’Neal, the average height in the room is likely to be pretty close to the human average (Mediocristan). If one of those people is Jeff Bezos, however, suddenly the wealth average changes drastically (Extremistan).

Although one needs only an intuitive sense of phenomena like wealth and market returns to understand that they don’t adhere to the same rules as phenomena like height and weight, throughout the book Taleb provides a robust theoretical and statistical scaffolding for his claims about the differences between Mediocristan and Extremistan.

Cumulative Advantage in Extremistan

As exemplified by figures like Beyoncé and Jeff Bezos, social and economic advantages accrue highly unequally in Extremistan.

One reason for this disparity is the “superstar effect.” Coined by economist Sherwin Rosen to describe the unequal distributions of income and prestige in Extremistan sectors like stand-up comedy, classical music, and research scholarship, the “superstar effect” operates when marginal differences in talent yield massive rewards.

The superstar effect, it’s vital to note, is meritocratic—that is, those with the most talent, even if they’re only slightly more talented than their competitors, get the spoils. What a theory like Rosen’s fails to take into account, however, is that all-important aspect of life in Extremistan: dumb luck. Luck can lead to cumulative advantage.

Consider research scholarship for instance. Sociologist Robert K. Merton has observed that academics rarely read all the papers they cite; rather, they look at the bibliography of a paper they have read and pick sources to cite more or less at random.

Now imagine a scholar cites three authors at random. Then a second scholar cites those same three authors, because the first author cited them. Then a third does the same thing. Suddenly the three authors that have been cited are considered leaders in their field, all by dint of dumb luck.

The phenomenon identified by Merton’s study has been called both “cumulative advantage” and “preferential attachment.” These concepts describe the innate human tendency to flock to past successes, regardless of whether those successes are the product of merit or chance.

Although cumulative advantage/preferential attachment provides a better account of unfairness than the superstar effect—because it accounts for randomness in the distribution of advantage/preference—it still isn’t a perfect theory of Extremistan unfairness. This is because, according to cumulative advantage/preferential attachment, winners stay on top. Once an entity—a company, an academic, a professional sports coach—reaches a certain level of success, cumulative advantage/preferential attachments holds that that entity will continue to be successful, because humans naturally favor past success. But this doesn’t reflect reality.

For example, according to cumulative advantage/preferential attachment, Apple will forever be the king of consumer electronics, and Google will forever own the Internet. But even a cursory knowledge of business history shows a belief like this to be misguided. Consider this: If you tracked the 500 largest U.S. companies from 1957 to 1997, you’d discover that only 74 lasted the full 40 years. Some ceased to exist by virtue of mergers, but most simply failed. In other words, even in Extremistan, giants can occasionally be toppled by dwarfs.

Nevertheless, despite the possibility of creative destruction, Extremistan is defined by extreme concentration—of prestige, income, capital, influence, size, or what have you. These concentrations create the appearance of stability—larger, more powerful entities are more resilient—but they actually create the potential for catastrophic black swans.

———End of Preview———

Like what you just read? Read the rest of the world's best summary of "Black Swan" at Shortform . Learn the book's critical concepts in 20 minutes or less .

Here's what you'll find in our full Black Swan summary :

- Why world-changing events are unpredictable, and how to deal with them

- Why you can't trust experts, especially the confident ones

- The best investment strategy to take advantage of black swants