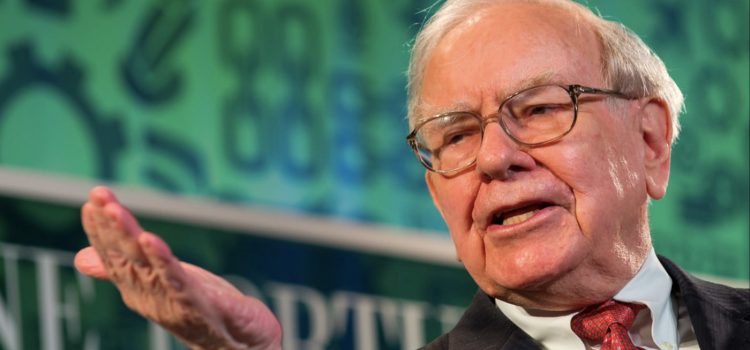

What kind of company is Berkshire Hathaway? What is Berkshire Hathaway’s business philosophy? Berkshire Hathaway is a multinational holding company run by Warren Buffett. Buffett takes the time to explain the reasoning and philosophies behind everything he does as Berkshire’s CEO so that his shareholders can fully understand the company that they own. Keep reading to learn about Berkshire Hathaway’s business philosophy.

Berkshire Hathaway’s Business Philosophy Explained