This article is an excerpt from the Shortform book guide to "The Essays of Warren Buffett" by Warren Buffett and Lawrence A. Cunningham. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here.

What kind of company is Berkshire Hathaway? What is Berkshire Hathaway’s business philosophy?

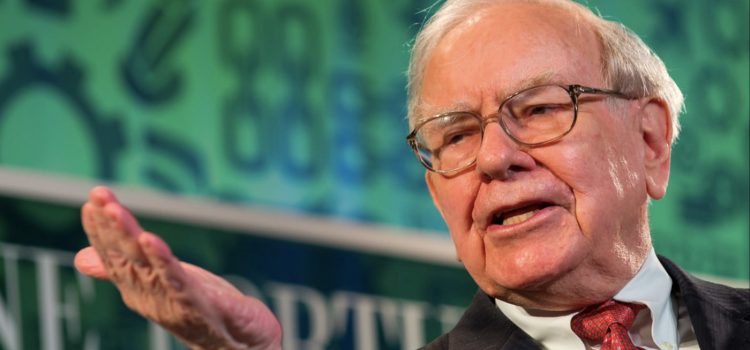

Berkshire Hathaway is a multinational holding company run by Warren Buffett. Buffett takes the time to explain the reasoning and philosophies behind everything he does as Berkshire’s CEO so that his shareholders can fully understand the company that they own.

Keep reading to learn about Berkshire Hathaway’s business philosophy.

The Berkshire Hathaway Way

To begin with, Berkshire Hathaway’s business goal is to increase its overall value per share, not the size of its holdings. It does this by owning and acquiring companies in good financial standing that produce respectable returns on capital investment. Buffett also wants the company’s shareholders to fully understand Berkshire’s financial position and the value added by its subsidiary companies (what Buffett refers to as “look-through earnings”). To do this, Berkshire goes beyond standard financial reporting practices to give shareholders the same information any owner would want about their business’s financial and managerial standing.

(Shortform note: The generally accepted accounting principles (GAAP) that Buffett frequently takes issue with are established by the Financial Accounting Standards Board, a nonprofit organization recognized by the US Securities and Exchange Commission as being the arbiters of what constitutes fair and transparent financial reporting. The FASB has been criticized for not responding quickly enough to changing accounting practices and the creation of increasingly complex financial instruments. Nevertheless, the FASB releases updates to GAAP throughout the year, sometimes on a near-monthly basis.)

Even though Berkshire’s stock price is already very high, Buffett doesn’t necessarily want it to shoot up even higher. Instead, he wants the stock price to reflect the company’s true value as closely as it can. This, he says, will attract investors who share Berkshire Hathaway’s values and culture of rational investing and long-term commitment. Berkshire isn’t a place for day traders, and it doesn’t pay out dividends to investors. Instead, it uses its massive earnings to allocate capital where it can have the most impact on the corporation’s overall worth.

(Shortform note: Though Buffett’s essays were written over a period of decades, they remain consistent in reflecting that he’d rather Berkshire’s stock be fairly priced than overvalued. Nevertheless, Berkshire Hathaway’s “Class A” stock is by far the most expensive in the world, trading at almost $500,000 per share, five times the amount of its closest stock price rival, the Swiss candy company Lindt and Sprüngli. Berkshire’s “Class B” shares, which represent smaller ownership and voting rights, are more within the reach of the everyday investor. Berkshire’s Class A stock price grew so high that it caused computer problems for the Nasdaq’s online stock exchange.)

Buffett says he views his investors as partners, and it’s important that he, as CEO, be open and accountable for his decisions. Therefore, he reports to a board of directors who are all required to be owners as well. In order to hold a place on Berkshire’s board, each director must own at least $4 million in Berkshire stock that was purchased outright, not through options or grants. That way, the directors’ earnings rise or fall along with all other shareholders’, and they won’t make decisions that benefit themselves at other shareholders’ expense.

(Shortform note: Buffett’s “partnership mindset” toward investors has roots far deeper than Berkshire Hathaway. As Alice Schroeder recounts in Buffett’s biography, The Snowball, Buffett’s first business venture after leaving Wall Street was the formation of Buffett Associates Ltd. in 1956—an investment partnership between himself, friends, and family. Buffett would invest his partners’ seed money and take his own share from a percentage of their earnings. In order to ethically share his partners’ risk, the terms of the business would penalize Buffett if the value of the partnership’s investments went down. He dissolved Buffett Associates in 1969 when he felt he’d no longer be able to match the returns he’d provided his partners in the previous decade.)

As for the managers of Berkshire’s subsidiaries, Buffett awards bonuses based on performance, which he makes clear are not dependent on Berkshire’s stock price going up. Instead, CEO compensation is judged on the nature of their businesses, the challenges they face, and the real returns they generate. Berkshire’s managers are, of course, welcome to buy the company’s stock at market price just like everyone else. If they do, then unlike CEOs with stock options, their interests will truly be aligned with the owners.

(Shortform note: In Built to Last, Jim Collins and Jerry Porras go beyond issues of CEO pay to debunk the basic premise that a charismatic, high-powered CEO is beneficial to a company’s standing. Instead, good management focuses on building the organization and its products rather than increasing managers’ own personal wealth and recognition. More than merely being aligned with shareholders, Collins and Porras suggest that a good CEO will be aligned with the company’s core philosophies and principles, which reach beyond shareholder interests to increase the benefit the company provides to the world.)

Growing the Berkshire Family of Businesses

Buffett happily admits that acquiring new businesses is his favorite part of his job. While in his youth he looked for mid-range businesses available for cheap, with Berkshire he seeks out high-quality companies that he can buy for fair prices. Such good deals are rare today, so he doesn’t set any acquisition targets. Instead, for every opportunity that arises, he compares the potential value of an acquisition to other, more conservative ways to invest. This removes the pressure for growth that drives many CEOs to rush into acquisitions based on arbitrary goals.

(Shortform note: A 2018 study identified several irrational factors that drive corporate acquisitions. Among these are greed, a desire for more power, antagonism between competing companies, and the hubris that companies making acquisitions feel when they believe they can perform better than others. The authors of the study recommend that companies involved in corporate acquisitions examine their motives from an emotional perspective to avoid any unintended consequences that may result from irrational decision-making.)

Though Buffett views each acquisition with a critical eye, once Berkshire buys a controlling share, Buffett lets his new acquisitions conduct their business with minimal interference. It’s not Berkshire’s policy to buy up smaller companies only to tear them apart and sell them off. Instead, Buffett portrays himself as the ideal buyer for companies whose owners want the businesses they built to carry on without them. For this reason, Berkshire never sells off an acquisition so long as it can produce even a modest return on investment, recognizing that a mid-tier business is still a vital source of income for its employees and their families.

(Shortform note: In The Snowball, Schroeder gives several examples of businesses that Buffett absorbed into the Berkshire conglomerate while keeping their essential character intact. One that exemplifies Buffett’s preferred type of acquisitions was Omaha’s landmark Nebraska Furniture Mart, founded by Rose Blumkin, a Russian immigrant who was 40 years Buffett’s senior and whom he looked up to greatly. When Blumkin decided to sell, Buffett arranged to keep her family on as partners so that the store would continue to run as it always had with Buffett merely providing the capital it needed in order to keep turning a profit.)

In keeping with Buffett’s philosophy of investing, Berkshire never leverages debt to buy new businesses. Instead, it maintains a ready supply of cash from its various subsidiaries to be used for acquisitions. In times when there aren’t any businesses to buy, that cash can be used to buy back shares of Berkshire stock. This is only done if Berkshire’s stock is trading below the company’s actual value, and Buffett explains how such buybacks serve the interests of Berkshire shareholders. After all, if Buffett reduces the number of slices in the Berkshire pie, the shares that remain increase in value without their owners having spent a dime.

(Shortform note: One other benefit of stock buybacks is that they can result in larger dividend payouts for those who remain as shareholders. Buffett doesn’t bring this up because unlike most profitable companies, Berkshire doesn’t pay dividends at all, instead choosing to reinvest all of its profits to increase share value in other ways. However, some CEOs use buybacks as a tool to push stock prices up. While this may result in higher earnings per share, those earnings are an artificial product of accounting and don’t reflect actual growth in a company’s productivity, and may in fact be harmful in the long run because buybacks spend capital that might otherwise be used to invest in more productive assets for the corporation.)

That owner-centric mindset is at the heart of Berkshire Hathaway’s culture, one which Buffett says he’s carefully cultivated so that it will last even after he’s gone. While describing what makes Berkshire work, he admits that its model would be difficult to replicate. His wealth and Berkshire’s grew over decades in which much changed in the financial world. Though he doubts it’s possible for Berkshire’s gains in the next 50 years to match its first half-century, he has full confidence in the business he created to thrive and endure in the decades to come.

(Shortform note: Because the practices and rules of high finance have changed so much in Buffett’s lifetime, it’s impossible to copy his road to riches exactly. However, Buffett encourages the wealthy to copy him in other ways, especially when it comes to philanthropy. In 2010, Buffett joined with Bill and Melinda Gates to challenge the richest people in the world to leave the majority of their wealth to charity. From 40 original signatories, the Giving Pledge has now been taken by over 200 billionaires.)

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Warren Buffett and Lawrence A. Cunningham's "The Essays of Warren Buffett" at Shortform.

Here's what you'll find in our full The Essays of Warren Buffett summary:

- A glimpse into the mind of a man who disagrees with the typical Wall Street mogul

- Buffett's simple yet difficult insights on investing

- Why some of the most widely accepted economic practices are wrong