This article is an excerpt from the Shortform book guide to "A Random Walk Down Wall Street" by Burton G. Malkiel. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here .

What is a beta risk? What is the difference between systematic vs unsystematic risk? Does this particular kind of risk involve higher premiums?

The key characteristic of systematic risk, better known as “beta risk” is that it cannot be diversified away by having a diverse portfolio. And researchers found that because it can’t be diversified away, beta risk is the only kind of risk that pays a “risk premium”—that is, a higher return for the higher risk.

Keep reading for more about beta risk, and whether it actually leads to a higher premium.

Beta Risk and Modern Portfolio Theory

Before delving into an exploration of beta risk, it’s important to understand Modern Portfolio Theory.

Modern Portfolio Theory (MPT) offers a strategy of managing risk: diversification. A diversified portfolio is one that features holdings in a variety of industries, countries, and asset classes. The idea is that, when your holdings in one industry, country, or asset suffer, your holdings in other industries, countries, and assets will offset your losses.

MPT led to a number of advances in the analysis of risk, including the distinction between unsystematic risk and systematic risk.

Unsystematic vs Systematic (Beta) Risk

In the scholarly literature on finance, a stock’s “unsystematic” risk describes the variability in its returns due to aspects of the stock in particular. For example, a biopharmaceutical company that has recently gone public might suffer a setback in its research, an executive departure, or the failure of a clinical trial. These events, considered part of the unsystematic risks associated with the stock, might result in a decline in the stock’s price.

The key component of unsystematic risk, at least as far as returns are concerned, is that it can be diversified away. For example, if an investor is worried about that biopharma company’s prospects, he or she can invest in an established blue-chip stock to offset the volatility in the biopharma stock.

A stock’s “systematic” risk—its “beta”—consists in its sensitivity to the stock market in general. For example, say that the biopharma company we’ve been discussing has received funds for five years of work. For those five years, the company might have relatively low systematic risk—given the fact its funding is already in hand, its operations might not be much affected by market volatility.

As you might expect, beta cannot be diversified away. This is because all stocks, to some degree or other, parallel the market (that is, when the market falls, by definition so too do stocks in general). At least in terms of common stocks, there is no such thing as a risk-free investment; even the most diversified holdings—for example, those contained in a broad market index fund—entail some risk.

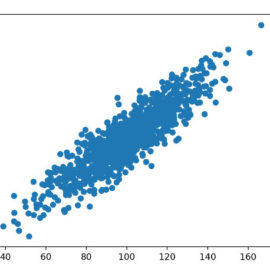

Individual betas are calculated using relatively high-level mathematics, but the concept behind the math is simple: A stock’s beta consists in a comparison of its price movements over a certain period of time with the market’s movements over that same period.

In practice, beta analysis looks like this: A broad market index is assigned a beta of 1, and stocks’ betas are calculated based on how big or small their price swings are in relation to the market’s. If a stock’s price drops twice as much as the market when there’s a downturn, that stock earns a beta of 2; if a stock gains half as much as the market when there’s an upswing, that stock has a beta of 0.5.

Risk and Returns

What financial innovators like Sharpe, Lintner, and Black realized was that if diversification could mitigate almost all unsystematic risk, investors wouldn’t receive a “risk premium”—an above-average return—for holding that type of risk. Rather, investors would only receive a risk premium for investing in assets with higher betas.

We can illustrate this fact by a thought experiment involving two well-diversified batches of securities. Each batch contains 60 stocks and features a beta of 1 (that is, its systematic risk is the same as the market’s). The only difference between the two batches is that each of the stocks in Batch 1 has higher unsystematic risk than each of the stocks in Batch 2.

Now, before the advent of MPT and beta, financial analysts believed both unsystematic and systematic risk (together, total risk) were rewarded with higher returns. Under the old thinking, Batch 1 would confer higher returns, because investors were taking on more total risk investing in those securities. (Those higher returns are generally realized by dint of lower initial prices for the riskier stocks.)

But what MPT proved is that a well-diversified portfolio of 60 stocks will essentially eliminate unsystematic risk. That is to say, even though each individual stock in Batch 1 has higher unsystematic risk than each individual stock in Batch 2, the aggregate unsystematic risk of the two batches is the same (0, or close to it). Because the systematic risk—the beta—of the two batches is the same as well, returns for the two batches over the long run will be the same.

Another way to think through this logic is to consider investor behavior if the above weren’t true. For example, say that Batch 1 did confer greater returns than Batch 2. If that were the case, investors would flock to Batch 1 securities. This investor interest would drive up Batch 1 prices (thereby reducing their returns) and reduce prices of Batch 2 securities (thereby increasing their returns). Before long, the securities in the two batches would reach equilibrium—neither would be more profitable than the other.

In the end, what matters for returns is beta—stocks’ sensitivity to market shifts.

Beta Risk’s Popularizer: CAPM Theory

Created by Sharpe, Lintner, and Black, the capital-asset pricing model (CAPM theory) was the go-to method of asset valuation on Wall Street in the late ‘80s and early ‘90s—and it made beta the hot concept among security analysts.

CAPM theory provides a means of valuing a stock according to its (systematic) risk and potential reward. At its most basic level, CAPM theory compares a stock’s potential return based on its beta with the “risk-free” rate of return (typically represented by the interest rate on a government-insured savings certificate). CAPM theory shows that as beta rises, so do returns.

For example, an investor with all his money in a government-guaranteed savings certificate has a beta of zero, because the rate of return isn’t affected by movements in the market. According to CAPM, that investor’s returns increase as his beta increases—for example, by investing in an index fund or investing on margin.

Are Beta-Based Valuations Sound?

Beta’s influence among security analysts is due, in part, to its simplicity: It consists in a single number that heralds future returns. But simplicity doesn’t necessarily equal correctness.

In a famous 1992 paper, financial economists Eugene Fama and Kenneth French used stock-return data from the period 1963–1990 to show that stocks with higher betas did not realize higher returns. In other words, Fama and French found that there was no relationship between a stock’s beta measures and its returns.

Malkiel has confirmed Fama and French’s findings through his own study of mutual funds—according to Malkiel’s research, mutual funds with higher betas also don’t produce higher returns over the long run.

Nevertheless, Malkiel isn’t quite ready to consign beta risk to the dustbin.

For one, even if a higher beta doesn’t necessarily entail bigger long-run returns, it does provide investors with actionable intelligence. For example, if Fama and French are right and higher betas don’t confer higher returns over the long-run, investors can use that knowledge and gravitate toward lower-beta stocks (which will secure them the same long-run returns with less volatility).

Also, it’s important to note that beta is nearly impossible to measure precisely. Many measures of beta use the S&P 500 Index as a proxy for the “market”—but the S&P 500 is actually a relatively select snapshot of the thousands of domestic and international stocks that comprise the market. More recent studies of beta than Fama and French’s have shown that, with more capacious indices of the market and more sophisticated measures of beta, higher betas are in fact predictors of higher long-run returns.

Beyond Beta Risk: Alternative Means of Measuring Risk

Because the usefulness of beta risk continues to be disputed, scholars of finance have sought alternative models for measuring risk and predicting returns. Two of the most well-known approaches are arbitrage pricing theory and the Fama-French three-factor model.

Arbitrage Pricing Theory

Pioneered by MIT economist Stephen Ross, arbitrage pricing theory (APT) builds on the (correct) insight that undergirds CAPM: that investors shouldn’t be rewarded for carrying unsystematic risk.

Where APT advances on CAPM is in its calculation of systematic risk. Whereas CAPM limits itself to beta—the sensitivity of stock or portfolio returns to those of the market in general—APT considers a host of systematic risk factors in addition to beta, including changes in national income, inflation, and interest rates.

Nevertheless, although APT’s more sophisticated calculation of risk shows promise, it still isn’t a foolproof method of measuring risk. (Shortform note: Malkiel doesn’t explain why it isn’t foolproof.)

Fama-French Three-Factor Model

APT is what’s known as a “factor” model—it “factors” an array of systematic risks into its calculations.

Another factor model, the Fama-French three-factor model, advances on CAPM by including two factors in addition to beta: the size of the company whose stock is being evaluated and the ratio of that company’s stock price to its “book” value. (A company’s “book” value is its total assets minus liabilities.) Fama and French argue that smaller companies are inherently riskier due to lower revenue streams or less robustness; they also argue that a low market price and high book value is a bear signal for that stock.

In short, the logic underlying both Fama-French and APT is the same: When assessing a stock’s systematic risk, measuring beta alone simply isn’t enough.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Burton G. Malkiel's "A Random Walk Down Wall Street" at Shortform .

Here's what you'll find in our full A Random Walk Down Wall Street summary :

- A comprehensive and entertaining introduction to the world of finance

- Practical investment principles that work for every skill level

- The advantages of index investing