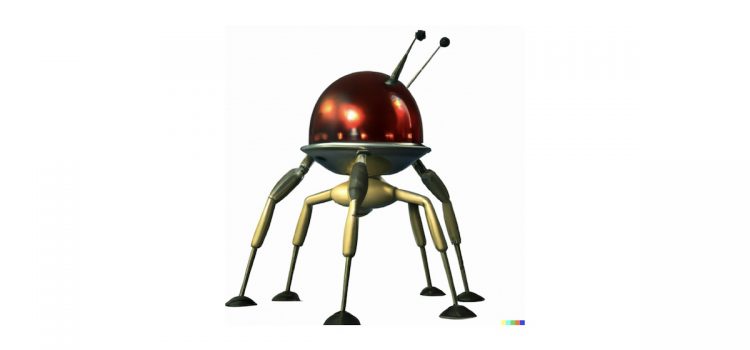

What are nanobots? How might they change the world? Where is nanobot technology today? According to Ray Kurzweil, nanobots could make sweeping changes in manufacturing and medicine. He explains how nanotechnology has the potential to overturn our entire materials-based economy and even eliminate scarcity. Read more to learn about nanobot technology and what Kurzweil sees in our future.

Ray Kurzweil: Nanobots Could Reshape the World as We Know It