This is a free excerpt from one of Shortform’s Articles. We give you all the important information you need to know about current events and more.

Don't miss out on the whole story. Sign up for a free trial here .

Why is rent inflation a problem? What’s causing the increase? If your rent increases due to inflation, what are your options?

Since the start of the pandemic, rent inflation—a general increase in rent prices due to inflation—has plagued renters in the U.S. and around the world. Many renters (especially low-income ones) are cash-strapped, saving less, and at risk of getting evicted.

Keep reading to learn more about inflation-related rent increases, including what to do if you’re a renter.

What Is Rent Inflation?

Since the early pandemic, rent inflation—a rise in rent prices—has plagued renters in the U.S. and beyond. Some are calling it a “global rental crisis.” In the U.S., rent increases due to inflation have reached an all-time high—rents have risen by an average of 6.3% over the past year—the highest increase in the past 35 years. Rent hikes are highest in Southern cities popular with retirees: For instance, rents in Miami and Tampa are 50% higher than pre-pandemic rents. Furthermore, rent inflation exceeds 15% in several East Coast and Midwestern cities such as New York City and Cincinnati.

Why Is Rent Inflation a Problem?

In the U.S., rent prices are increasing due to inflation even faster than incomes are, leading to problems for renters:

- Less money for other expenses, like food

- Risk of eviction: Nearly 40% of renters worry they’ll be evicted before the end of 2022.

- Less money to save, which may make it hard to afford downpayments for future homes

A rent increase due to inflation is especially hard on new renters (who aren’t locked into earlier prices) and lower-income groups: full-time students, immigrants, low-income families, retirees, and families of color. Because a disproportionately high number of families of color are renters, rent inflation is a racial justice issue.

Why Is Rent Inflation Happening?

The main reason behind U.S. rent inflation is a low supply of rental units and a high demand for them, which has developed for two primary reasons: high interest rates and the pandemic.

Reason 1: High Interest Rates

The Federal Reserve has been raising interest rates to fight overall inflation. This reduces the supply of rental units because it discourages investors from purchasing real estate that they’d rent out as apartments or condos, reduces new construction, and prevents renters from leaving the market to buy homes.

Reason 2: The Covid-19 Pandemic

The pandemic has also contributed to the low supply and high demand for rental units. On the supply side, construction of new rentals couldn’t keep up with demand during the pandemic due to construction delays, labor shortages, and higher costs of materials.

Then, the pandemic led to a surge in new renters and forced some would-be homebuyers to continue renting. More people started working from home, and many moved into larger spaces. Furthermore, some who lived with family and friends during the pandemic got tired of sharing space and left to find their own. Lastly, U.S. government stimulus money encouraged many to enter the housing market—this raised demand for homes and drove up home costs, leading some to opt to rent instead because they couldn’t afford to buy.

What’s The Government Doing About Rent Inflation?

While the U.S. Federal Reserve is tasked with controlling inflation, it has only blunt tools to do so, and it can’t directly lower rents. So, other federal agencies are trying to try to address the problem of rent increases due to inflation. For example, in the midterm elections, voters in cities such as Portland voted in favor of rent stabilization measures. In addition, many are calling on the White House to step in: A coalition of 250 organizations recently demanded that Biden issue an emergency executive order that would protect renters from evictions and increase rent control.

In the meantime, the government is trying to at least ameliorate some of the pain caused by rent inflation: The Treasury Department’s Emergency Rental Assistance Program has spent $40 billion since the start of the pandemic helping renters in distress.

What Can Renters Do?

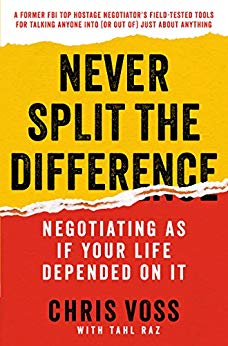

In Never Split the Difference: Negotiating as if Your Life Depended on It, Chris Voss (with co-writing assistance from Tahl Raz) provides a comprehensive guide to negotiating theory and strategy, which can guide you in trying to re-sign your lease at a reasonable rent if you’re facing a rent increase due to inflation.

Use the Ackerman Model for Negotiation

Voss recommends what he calls the Ackerman Model as a good alternative to traditional, old-school negotiating. Created by ex-CIA operative Mike Ackerman (who later founded a company advising law enforcement on kidnapping situations), this model improves on the traditional offer-counter system because it doesn’t end with you “meeting in the middle.”

The Ackerman Model follows these six steps:

- Choose a target price.

- Offer 65% of your target price.

- Offer three raises, at 85%, 95%, and finally, 100% of your target price.

- Say “no” without saying “no” outright.

- Offer a precise number, strange number.

- Offer a non-monetary item as well.

1. Choose a Target Price

This should be ambitious, but reasonable. You don’t want to negotiate with yourself and set your target price too high (if you’re the buyer), but you also don’t want to set it so low that your counterpart would never agree to it. Doing some research beforehand will help you set your goal.

2. Offer 65% of Your Target Price.

Thus, if you’re aiming to pay $100,000, your opening bid should be $65,000. This is a starting bid designed to catch your counterpart off guard. Voss writes that an extreme starting bid like this can also trigger your own sense of loss aversion in a constructive way. By starting with a low offer, you’ll start thinking of anything higher than that as a “loss,” which you’ll work hard to avoid. In reality of course, you’re still well below your target price at this point, so even if you move off your opening bid it’s still a “win” for you. In addition, says Voss, your bid can force your counterpart to reveal their own price limit. If they balk and say something like, “I couldn’t possibly sell for anything less than $75,000,” that means you’ve just forced them to reveal their price floor.

3. Make Your Counterparts Negotiate Against Themselves

When they throw you an unacceptable counteroffer, use an open-ended question like “We’ve talked over my fixed costs already. Given that, how can I pay the price you’re asking for this?” Get them to think about how they can solve your problems.

4. Plan Your Counteroffers

When planning your counteroffers, use three increases—but each time, you reduce the size of the increase. For example, Voss recommends countering at first with a number that’s 85% of your target price (a 20 percentage-point jump). Then, you increase it to 95% of your target price (only a 10 percentage-point jump this time). If they’re still not accepting this, then finally you meet them at your full target price (which by this point is a modest 5 percentage-point jump). All of this activates your counterpart’s inclination toward reciprocity. They’ll be inclined to match your raises with concessions of their own.

There’s also great power in the decreasing increments of your offer increases. They fool your counterpart into thinking that they’re squeezing you for every last penny. This makes them feel like they’re in control and that they’re earning hard-won concessions from you. Of course, you know that you’re still well below your target price.

5. Use a Precise, Non-Round Figure for Your Final Number

This gives it added weight and credibility, as Voss mentioned during the analysis of framing effects. Something like $99,321.94 sounds like a much firmer, more non-negotiable number than $100,000. This will signal to your counterpart that this number is the product of a great deal of calculation and analysis on your part and that, therefore, it can’t be negotiated.

6. Throw in a Non-Monetary Item

Include a non-monetary item along with your final offer to signal that you’re truly at your limit. By pivoting to something other than money, you’re sending a message to your counterpart that the monetary portion of the negotiation is over and done with and you’re ready to move on to other items.

Negotiating Your Rent: An Ackerman Model Walkthrough

Here’s an example of how to negotiate your rent price if you’re facing a rent increase due to inflation. A student who was paying $1,850/month for an apartment was presented with an unacceptable offer by his landlord: the rent would go up to $2,100/month if he wanted to renew.

How did the student respond? First, he did his research on rents for comparable buildings in the area and set his target price at $1,830: less than he was already paying!

When the student met with the landlord, he emphasized how much he enjoyed living in the building and that he wished to renew, but that there were comparable buildings in the area that offered lower rents. He asked his first calibrated question: “How am I supposed to pay $250 extra per month?”

- The landlord, however, didn’t budge and pointed out that the building could be charging even more than they were asking the student. Then, the student responded with his first offer: “I understand that you have a great building and could be charging a premium, but it’s simply outside my price range. Would $1,730 be reasonable?”

- The landlord didn’t accept this figure, which the student expected. But he wisely avoided getting pulled into a tit-for-tat. Instead, he asked another calibrated question: “How much does it cost to refurbish an apartment after a tenant leaves?”

- The landlord responded that it could cost up to $2,000 just to clean and renovate the apartment to get it ready for a new tenant. The student knew he had an opening: he pointed out that not reaching an agreement meant that the landlord could face both the refurbishing costs and the foregone income from rent. Now, the landlord was thinking in terms of loss aversion.

The landlord then came back with an offer of $1,950. This time, the student used a label to say “no” without actually saying it, by telling the landlord, “That offer is very generous, but I still can’t make that number work. It seems like you’d prefer to roll the dice and risk leaving it unrented than work this out with me.”

- The landlord gave the student the “no” he was looking for by saying, “No, that’s not the case at all, we want to work out a renewal with you, we just can’t offer below market.”

At last, the student pulled out his final, non-round number. He told the landlord, “All right, I see you’re being reasonable and working hard to address my concerns. The most I can do is $1,829.”

The landlord was impressed with the number. “You seem very precise about that figure,” he observed. “I think we can make that number work.” And that’s how this student used the Ackerman Model to turn a rent increase into a rent cut.

Never Split the Difference

by Chris Voss and Tahl Raz

33 min reading time

61.1k reads

audio version available

Want to fast-track your learning? With Shortform, you’ll gain insights you won't find anywhere else .

Here's what you’ll get when you sign up for Shortform :

- Complicated ideas explained in simple and concise ways

- Smart analysis that connects what you’re reading to other key concepts

- Writing with zero fluff because we know how important your time is