How did the East India Company govern in Bengal? How did it contribute to one of the worst disasters in the region’s history? What’s the Bengal Bubble?

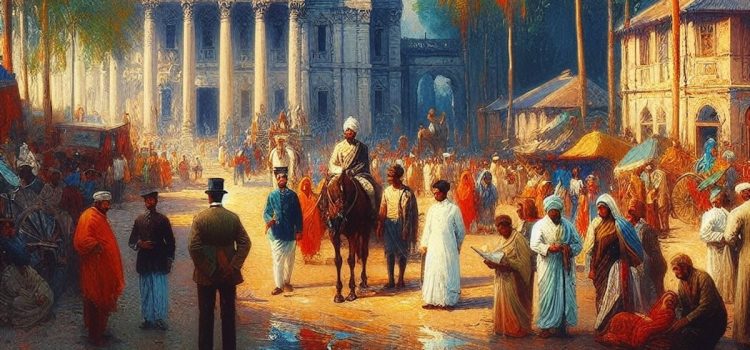

After the collapse of India’s Mughal empire, the East India Company expanded its trading operations and military capacity. The company set its sights on Bengal, a wealthy province on India’s northeastern coast. It took advantage of political chaos to rise to power.

Read more to learn about the East India Company in Bengal, specifically how it maintained and used its power and the impact it had on the province.

The East India Company in Bengal (Mid- to Late 18th Century)

The rise of the East India Company in Bengal is attributed to their ability to build up military capacity and successfully challenge the Mughal rulers. We’ll explore how the company maintained power and governed the province. We’ll also describe the consequences of its policies, which drained the economy of Bengal, led to a disastrous famine, and triggered a financial crisis in Europe. Finally, we’ll discuss Britain’s reaction to company rule, which led to a shift toward more government oversight for the EIC.

How Did the Company Govern?

Historian William Dalrymple states that the EIC established rule over Bengal by carefully maintaining the old Mughal hierarchies. The tax collectors, soldiers, petty officials, and law agents were all the same as before. However, EIC men now sat at the top of every hierarchy.

This was done because 1) the company didn’t have enough personnel to run the Bengal state on its own, and 2) EIC members knew that ordinary Bengalis would be less likely to revolt if the new regime looked more or less like the old one. The EIC also consolidated its rule by maintaining alliances with the Mughal princes it had just defeated.

A second key component of the EIC’s governance consisted of systematically draining wealth from the Bengal economy. Though it now ruled a territory and subjects, the EIC still saw itself as mainly a joint-stock corporation whose primary responsibility was to its shareholders. Thus, the company sent as much wealth as possible back to England. The EIC used the tax revenue of the Bengali people as another stream of business revenue, spending most of it on trade goods bound for resale in England.

| The Problem of Corporate Governance The example of the EIC’s governance in Bengal continues to play an important role in modern debates about corporate responsibility and accountability. As a corporation with its own military, mint, territory, and laws, the EIC provides an extreme case study of what happens when the lines between governments and corporations are blurred. Governments and corporations are historically understood as entities with distinct responsibilities. Governments have much greater authority to set laws and apply coercive force, but they also have a moral obligation to the interests of their citizens—at least in theory. Corporations, on the other hand, have only an obligation to increase profits for their shareholders but are theoretically supposed to operate within the legal frameworks established by governments. By blurring the lines between corporations and governance, the EIC combined the power and authority of governments with the narrow responsibilities of corporations. This enabled it to collect taxes from Bengali citizens and hand this wealth to their shareholders in the form of a dividend rather than investing it back into Bengal. This conflict of interest has implications in debates over other situations where the line between government and corporate interests is blurred. For example, today, there’s a rising concern about how much influence corporations are allowed to exert over governments through lobbying and campaign contributions. Critics also worry about what should be done in situations where powerful multinational corporations are operating in countries with weak governments. |

What Were the Consequences of the Company’s Rule?

Dalrymple argues that the EIC’s policies of wealth extraction had disastrous consequences for Bengal. Since none of the extracted wealth was reinvested in building the local economy, the province slowly became poorer and poorer. The EIC had reversed the flow of capital that had been coming into India since the earliest days of the spice trade. Now, money flowed from India to Europe at an alarming rate. In less than a decade of EIC rule, Bengal, once the wealthiest province in India, became one of the poorest. This led to two catastrophic events: the Great Bengal Famine and a financial crisis in Europe.

| How Much Wealth Did India Lose Through Colonialism? Economists and historians have attempted to calculate the total value of the wealth siphoned from India to Britain through colonial wealth extraction. The economic historian Utna Patnaik places the figure at almost $45 trillion between 1765 and 1938. However, this direct transfer of wealth may not even have been the largest economic impact. Economist Amartya Sen argues that British wealth extraction may also have slowed down India’s industrialization. Sen compares India to Japan, which was never incorporated into a European colonial empire and industrialized during the Meiji Restoration in the late 19th century. While India made some steps toward industrialization under British rule, this growth significantly accelerated in the 1950s, when the newly independent government made it a priority of economic policy. Sen argues that India likely missed out on potential wealth through lost opportunities for economic development. |

1) The Great Bengal Famine

Dalrymple asserts the EIC’s neglectful governance and economic pillaging paved the way for the Great Bengal Famine, one of the worst disasters in the region’s history. In 1768-69, Bengal suffered its worst drought in years, and 70% of crops failed. Farmers started selling everything they owned, and the poorer laborers starved to death.

While the EIC’s Mughal predecessors had maintained storehouses of grain to prepare for droughts, the company had no famine relief program at all. The company board didn’t see this as the company’s problem, and it continued ruthlessly enforcing taxation to protect its bottom line. Though not an official company policy, private traders within the company also began hoarding grain to sell at exorbitant monopoly prices, making fortunes off the famine. An estimated 1.2 million people died, yet the company responded indifferently when locals tried to raise the alarm.

(Shortform note: The exact death toll of the 1770 Bengal Famine is unknown. The 1.2 million figure cited by Dalrymple was put forward by the economic historian Rajat Datta, a revisionist who argued that previous totals were inflated. However, some estimates have placed the number as high as 10 million. It’s difficult to accurately estimate the figure for two reasons: 1) there was very little data on the population at the time, and 2) much of Bengal’s enormous population loss could be attributed to displacement—people leaving the region in search of better conditions. However, it’s worth noting that Dalrymple is citing a conservative estimate.)

2) The Financial Crisis in Europe

Dalrymple asserts that these catastrophes set off a chain reaction that ultimately plunged Europe into a financial crisis. First, the destruction of Bengal’s economy dried up the EIC’s revenues. When Bengali citizens couldn’t pay taxes, the EIC lost much of its income. As a result, the company struggled to meet its financial obligations, defaulting on customs fees and loan payments back in Europe. As news of its failing finances spread, the company’s share price started to fall. Many European bankers had overinvested in EIC stock, and the company’s sudden decline caused over 30 banks to fail, triggering a recession across Europe.

| How Do Asset Bubbles Cause Recessions? Financial historians refer to this crash as “The Bengal Bubble.” We can shed light on this particular chain of events by examining the leading economic theories on how asset bubbles work and why they trigger recessions. Asset bubbles occur when the price of an asset (such as EIC stock) rises dramatically as buyers overestimate its value. This overvaluation snowballs as speculative investors expect that the price will continue to rise and, in anticipation of this appreciation, purchase extra assets. News of the asset’s rising value attracts even more investors due to herd mentality and the fear of missing out. The bubble “pops” when a price correction triggers a panic, and sellers try to get rid of the asset as quickly as possible before it depreciates further. This causes a dramatic drop in price, wiping out investments across the market (as demonstrated by the EIC’s falling share price). This sudden widespread loss of value can bankrupt financial institutions, leading to an economic downturn. Famously, a housing market bubble set off the 2008 financial crisis, and a stock market bubble contributed to the Great Depression of 1929. 18th-century European bankers likely overestimated the value of EIC stock because of their limited information on the company’s activities across the globe. Bankers saw high-value goods flowing into England and enormous dividends paid out to shareholders but didn’t understand the costs of running an empire or the destruction the company’s predatory governance was causing to Bengal’s economy. |

How Did the British Parliament Respond to the Famine and Financial Crisis?

The British Parliament realized it needed to control the damage done by the EIC’s financial policies. Dalrymple explains that the Parliament’s response fundamentally reshaped the relationship between the EIC and the British government.

This response sought to balance several competing motivations. First, the British elites realized both the value of Bengal to Britain’s economy and the liability of leaving it in the hands of a trading corporation. Furthermore, the EIC developed a bad reputation for violence and greed, even in England—leading to calls for greater government oversight from public critics and concerned officials. However, the British Parliament also sought to keep the EIC financially solvent. Britain’s economy was heavily intertwined with the company, and Dalrymple highlights that 40% of members of Parliament personally owned EIC stock.

The British Parliament first balanced the company’s finances with a £1.4 million bailout in 1773, a sum unheard of at the time. Second, Britain claimed the right to appoint governors in Bengal and selected Warren Hastings, a reformer in the company who had tried to blow the whistle on the destruction in Bengal. This set in motion a process of gradually increasing government oversight and control that would continue over the next century.

| Comparisons With the US Government’s 2008 Financial Crisis Response The British Parliament’s bailout of the EIC bears a striking resemblance to modern responses to financial crises, especially the US government’s reaction to the financial crisis of 2008. Here we’ll explore four key points of comparison. 1) Economic interdependence: Both the 18th-century British Parliament and the 2008 US government decided that certain industries were “too big to fail.” In other words, they played such an important role in the national economy that allowing their failure would put other industries and the rest of the economy at risk. 2) Bailouts: Both responses included extensive corporate bailouts. In 2008, the US government focused primarily on bailing out the financial sector. However, Britain’s response focused on stabilizing the stock price of the EIC with a direct bailout to the company, rather than bailing out the banks that had over-invested in EIC stock. 3) Lobbying: Corporate lobbying played a significant role in both government responses. The EIC lobbied Parliament for its vast bailout. In 2008, the US gave the largest bailouts to the banks that invested the most in lobbying. 4) New oversight: In both situations, the governments sought to impose new oversight on the industries whose actions triggered the collapse. In response to the 2008 crisis, the US government created a new office—the Consumer Financial Protection Bureau (CFPB)—to set regulations for financial institutions. While this bureau sets regulations and rules, it has little decision-making authority over the day-to-day operations of banks. In contrast, the governor appointed by Parliament exercised broad decision-making authority over the EIC’s colony in Bengal. |