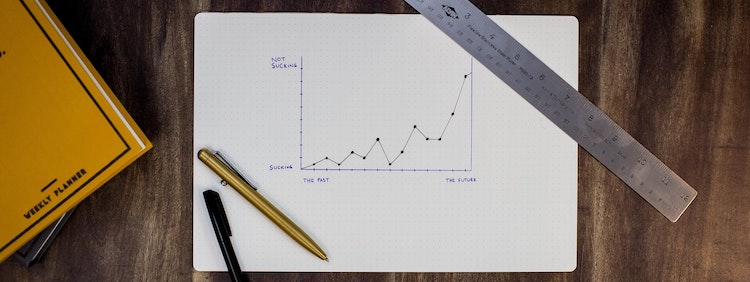

Do you know how to use a personal financial graph? Do you know how it can help you achieve financial freedom? In Your Money or Your Life, Vicki Robin and Joe Dominguez include using a financial graph as a step toward reaching financial independence. They share three benefits of charting your income and expenses, and they provide three steps for setting up your graph. Read more to learn how to use a financial graph to achieve financial freedom.

Set Up Your Financial Graph in 3 Easy Steps