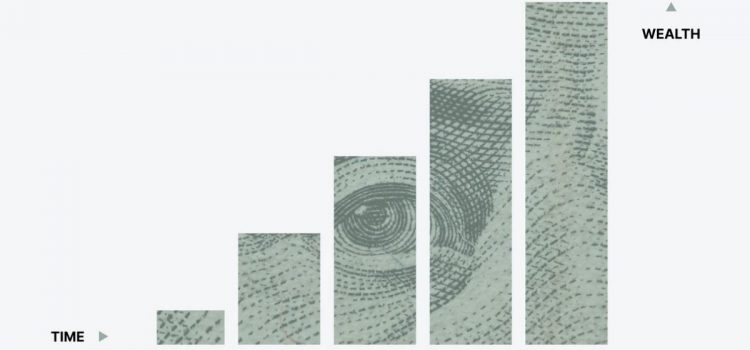

Is the economy an open or a closed system? Why does traditional economics treat the economy as a closed system? According to Kate Raworth, traditional economics has a closed-system model for the economy, which operates simply as a series of “inflows” and “outflows” of money, closed off from everything else. This model puts the economy in isolation and treats it as a machine, governed by a simple and predictable set of inputs and outputs. In an open economic system, on the other hand, the economy is embedded within the environment and the planet itself. Here’s why the economy is an

What’s an Open Economic System?