This article is an excerpt from the Shortform book guide to "I Will Teach You to Be Rich" by Ramit Sethi. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here .

Do you struggle to keep on top of your finances? Have you thought about personal finance automation?

Personal finance automation isn’t just convenient—it’s crucial. When you automate your finances, you bypass all the normal human flaws that get in the way of managing your money (like forgetting to pay a bill on time or not feeling motivated to think about investing), allowing your wealth to keep growing in the background while you focus on other things.

In this article, you’ll learn how to link all your accounts, create a system of automatic transfers between them to fund your investment and savings accounts, and schedule everything so that all your bills are paid on time—automatically.

How Automation Works

If you’ve ever tried to stick to a budget or keep track of your bills manually, you’ve probably noticed how hard it is to stay on top of your finances when you have to consciously think about where each dollar goes. It’s too easy to get distracted, bored, or overwhelmed, so we end up making costly mistakes or missing out on lucrative opportunities. Automation is different: Instead of requiring constant focus, automating your finances allows you to frontload the hard work by spending a few hours setting up your accounts; after that, you get to move on and focus on other things, knowing that your finances are taken care of and your money is growing itself.

In practice, here’s how automation works: You’re going to set up a system of automatic transfers between your checking account, credit cards, bills, savings, and investment accounts. Your checking account will be the central node of this system—once your paycheck lands in that account each month, your system will kick in and initiate transfers from your checking account into all your other accounts based on the percentages you came up with when planning your spending.

To make this more concrete, let’s give an example: If you made $100 today, how much of it would go into each area of your plan for expenditure? For example, your split might go like this: $60 would go to your fixed bills, $10 would go into your investments, another $10 would go into savings, and $20 would be guilt-free spending money.

Sample Transfer System

For a more specific look at how this works, let’s use the author’s friend Michelle’s transfer system as an example. Michelle contributes 5% of her pay to her 401(k) each month, so that money is automatically taken out of her paycheck before she gets paid. Then, her employer sends the remaining 95% of her paycheck to Michelle’s checking account via direct deposit. From there, her system kicks in, initiating a series of automatic transfers from her checking account over the next few days. Here’s how it works:

- First, Michelle’s fixed bills that can’t be paid by credit card are automatically paid out of her checking account. Meanwhile, all her other regular bills (like subscription services and her internet bill) are automatically paid from her credit card. At the end of the month, she’ll look over her credit card bill to catch any errors before that bill is paid in full with an automatic transfer from her checking account. By paying her bills this way, Michelle can rack up credit card rewards and build up her credit without worrying about incurring debt because her card is automatically paid off each month.

- Next, 5% of her paycheck is automatically transferred to her Roth IRA account (combined with her 401(k) contribution, she’s investing a total of 10% of her pay each month).

- Then, Michelle’s savings account pulls another 5% of her take-home pay. She’s set up this account so that it automatically divides her money between sub-accounts for her savings goals (like a wedding and an emergency fund).

- Finally, whatever’s left in Michelle’s checking account after all those automatic transfers go through is her spending money for the month. Michelle can spend this money completely guilt free because she knows that all her bills are already paid and she’s already saved and invested for the future.

Because Michelle often uses her credit card for her guilt-free spending, she sets up alerts in a financial software (like You Need a Budget) to alert her if she spends too much in a particular category. She also checks on her account balances once in the middle of the month to make sure she’s not overspending—if she is, she has the rest of the month to get back on track.

Setting Up Your Transfer System

Now that you’ve seen how much easier it is when your finances run themselves, it’s time to set up your own system of transfers. You’ll need to get a few things in order before you dive in. First, you’ll need a list of all your accounts and your login credentials for each of them (to make this easier, Sethi recommends using an online service called LastPass, which securely stores all your account information). Second, if you haven’t set up your 401(k) yet, you’ll need to do that too before you worry about automating. And finally, make sure you’re getting paid through direct deposit if your job allows for it (talk to your human resources representative to set this up). That way, your paycheck will reliably land in your checking account at the same time each month, without you having to manually deposit it.

Linking Your Accounts

Before you can set up automatic transfers, you’ll need to link all your accounts to one another. Generally, you’ll do that by logging into the destination account (so, for example, to link your checking account to your student loan bill, start from your student loan company’s website) and finding the “Link Accounts,” “Transfer,” or “Set Up Payments” option. Remember, you’re just establishing the links at this point—you’ll come back to set up the actual transfers later. Here’s what you need to do.

- Link your paycheck to:

- Your 401(k)

- Your checking account via direct deposit

- Link your checking account to:

- Your savings account

- Your credit card

- Any bills that can’t be paid by credit card

- Your investment account/Roth IRA

- Link your credit card to:

- All other bills

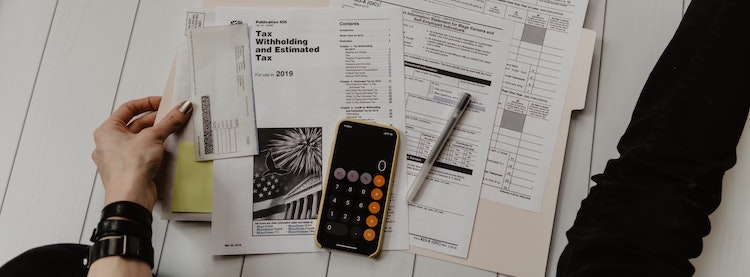

[image] IWT_moneyflow(2).png

If you have any bills that you can’t pay online (for example, if you rent from an individual landlord and pay by check every month), don’t worry—you can still automate it! Your checking account most likely has a free bill-pay feature, which you can set up so that your bank automatically writes your rent check and mails it to your landlord every month.

Scheduling Automatic Transfers

Now that your accounts are linked, you can set up automatic transfers using your previous plan for expenditure as a guide for how much to divert into your savings and investment accounts each month. Setting up those transfers is simple, but we’re going to take it one step further by scheduling all of them so that they happen within the first week of you getting paid. This makes the whole process much simpler—if you get paid on the first of the month, you’ll know by the seventh of the month that all your bills are paid, your savings and investments are funded, and you can spend the rest of the month spending the leftover money however you want. This also helps you avoid accidentally spending money early in the month that was supposed to pay off a bill that’s due at the end of the month.

The first step to scheduling this system is to get your bills on the same schedule. Luckily, most companies now let you choose which day of the month your bill arrives (to choose a new day, you can call the company or check their website). To keep things simple, schedule all your bills to arrive on the same day you get paid each month. Here’s how the whole system should look if you get paid on the first of the month.

| Day of the month | Action |

| 1 | Your paycheck is issued (but might not show up in your account yet). All bills arrive. |

| 2 | Your employer automatically sends your 401(k) contribution to your 401(k) account.Your take-home pay shows up in your checking account via direct deposit. |

| 5 | Automatic transfer sent from your checking account to your savings account.Automatic transfer sent from your checking account to your Roth IRA. |

| 7 | Auto-payments sent for all bills (from your credit card or your checking account).Auto-pay your credit card bill (preferably in full) from your checking account. |

You may notice that nothing auto-transfers out of your checking account until the 5th of the month. That gives you a full four days of leeway to make sure your paycheck deposits correctly, which protects you against overdrafts and late fees. Similarly, when you set up auto-pay on your credit card bill, set up an automatic email notification to arrive with your bill each month (you’ll find this option under “Notifications” or “Bills”). That way, you can look over the charges and even adjust the amount of your automatic payment if needed (for example, if you’ve accidentally charged more money on your credit card than you have in your checking account).

(Keep in mind: This is how your system should look when you’re able to fully carry out your plan for spending your money. That may not be the case for you right away (for example, if you can’t afford to save a whole 5% of each paycheck, or if you have credit card debt and can’t pay it in full), but it’s still important to set up this system, even if you’re only transferring $5 into each account. You can always add to that amount later on—in the meantime, you’re building good financial habits and a solid system that will grow with you as your wealth increases.)

As you schedule all the transfers in your system, make sure to leave some money in your checking account to act as a buffer against accidental overdrafts until you know everything is running smoothly. Once you’re confident in your system, you can reallocate that buffer money according to your initial plan for expenditure.

Alternate Schedule: Biweekly Pay

- The schedule above assumes you get paid once a month. Here’s what it looks like if you get paid biweekly:

| Day of the month | Action |

| 1 | Your first paycheck of the month is issued (but might not show up in your account yet). All bills arrive. |

| 2 | Your first paycheck shows up in your checking account via direct deposit. |

| 7 | Auto-payments sent for all bills (from your credit card or your checking account). Auto-pay your credit card bill (preferably in full) from your checking account. |

| 15 | Your second paycheck of the month is issued. |

| 16 | Your employer automatically sends your 401(k) contribution to your 401(k) account.Your take-home pay for this paycheck shows up in your checking account via direct deposit. |

| 19 | Automatic transfer sent from your checking account to your savings account.Automatic transfer sent from your checking account to your Roth IRA. |

Another way to schedule this system if you get paid twice a month is to save up a buffer of money in your checking account. That way, you can pay your bills and fund your investments and savings all during the first week of the month using a combination of your first paycheck and your savings buffer (you’d then use your second paycheck to rebuild that savings buffer). This technique lets you take advantage of the benefits of the default schedule (like having all your bills and payments taken care of within the first week of the month). If you decide to go this route, make sure to build up your savings buffer a little more than you think you’ll need to protect yourself in case anything goes wrong with your transfer system.

Alternate Schedule: Irregular Income

What if your income is irregular? For example, if you do freelance work, you might have some months where you make a lot of money and other months where you make none at all. In that case, you can still set up a transfer system; you’ll just need to create a savings buffer first. That way, you’ll be able to simulate a stable income by saving up enough money to pay yourself regularly, even during slow months. Here’s how to create that savings buffer:

- First, figure out the bare minimum amount of money you need every month to survive. Only include the basic necessities, like rent and food—ignore savings, investments, spending money, and any fixed costs you could potentially go without for a few months (like a gym membership). Once you total up that number, multiply it by three to find out how much you’ll need to save up in order to cover yourself for three months of low income (for example, if you need $3,000 to survive each month, you’ll need to save a total of $9,000 for your buffer). If you’re worried that three months may not be enough to cover you, you can double that total to calculate your six-month savings buffer.

- Next, set that buffer as a savings goal. This should be your first financial priority, which means you should temporarily divert all the money you’d normally save and invest each month toward this savings goal.

- Finally, once you’ve hit your savings goal, you can go back to saving and investing according to your plan for expenditure. However, if your income is irregular, you may want to tweak your plan to increase your monthly savings—that way, if you have to dip into your buffer, you’ll automatically be working toward building that buffer back up.

Another thing to keep in mind: If you’re self-employed, your taxes aren’t automatically withheld from your pay, so you’ll have to set aside a portion of your income for taxes each year. Sethi recommends saving 40% of your income for taxes—that may be more than you end up needing, but it’s always better to have money left over than to come up short at tax time. However, self-employment taxes can be tricky, so you’ll definitely want to talk to a tax professional.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Ramit Sethi's "I Will Teach You to Be Rich" at Shortform .

Here's what you'll find in our full I Will Teach You to Be Rich summary :

- The small steps you can take towards living a "rich life"

- How to choose the right bank account and manage your credit cards

- How to create a financial system that grows your money automatically